As well as the highest National debt ever, the UK is also suffering from a record level of Stealth Taxes. As tax on fuel has increased, the UK now has the most expensive petrol in Western Europe.

As well as the highest National debt ever, the UK is also suffering from a record level of Stealth Taxes. As tax on fuel has increased, the UK now has the most expensive petrol in Western Europe. The abolition of the married couples’ allowance (and replacement by Child Tax credits), the increase in stamp duty, the Company Car tax, the tax on pensions, the diversion of National Lottery funds to pay for public sector projects, the re-evaluation of council tax bands, the sale to mobile phone operators of licences for the use of blocks of transmission frequencies which were previously used for public services (As an example, in 2004 the Government held the UK 3G auction. This cost 3, Vodafone, BT, One2One and Orange nearly £22.5 billion (a total of £22,447,400,000) which they will then recover from the consumer over the 20 year contract period) and the auction of television frequencies after the switchover to digital are all other forms of stealth tax.

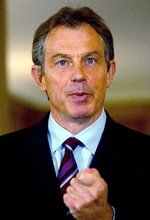

While Blair and Brown can claim that the UK is currently enjoying the lowest level of income tax it has had for decades, the increase in number of stealth taxes, and the revenue they generate, has meant that even as far back as 2001 tax increases were equivalent to a 10p increase in the rate of basic income tax.

For examples of UK stealth taxes since 1997, see: http://myweb.tiscali.co.uk/garbagegate/item2/stealth.htm

No comments:

Post a Comment